Understanding the consumer need landscape in India

LendStack is helping millions of Indians and micro businesses get access to automate stock inventory accurately and manage bulk stock in no time without asking for an arm and a leg. Keep note of all your inventory items & minimize stock wastage which means they are available around the clock, 365 days a year.

While it is true that an increasing number of microfinance industry in India are turning their attention to supply chains to create competitive advantage and improve the bottom line. Many small businesses still view supply chain management (SCM) as a mechanism to improve profits through cost containment. However, it is important to recognize that effective SCM focuses primarily on meeting customer needs, rather than on cutting costs. Improved relationships with customers and more efficient product delivery processes can result in a clear distinction between firms and lead to sales growth. Alternatively, if cost-cutting goes too far, the company may unknowingly eliminate services or product features that may be valued by customers.

The reality is that most micro businesses have significantly delicate situations where intense competition exists on price, product features and promotional initiatives. In commodity-type markets where the standard is high-level service at the lowest cost, firms must reduce wasteful practices across the entire supply chain to create significant value. For example, in businesses like consumer packaged goods and automobile parts, firms have little choice but to compete on service to gain differentiation. Adopting a customer-driven perspective enables firms to view the supply chain as a tool for creating market value, rather than simply controlling costs.

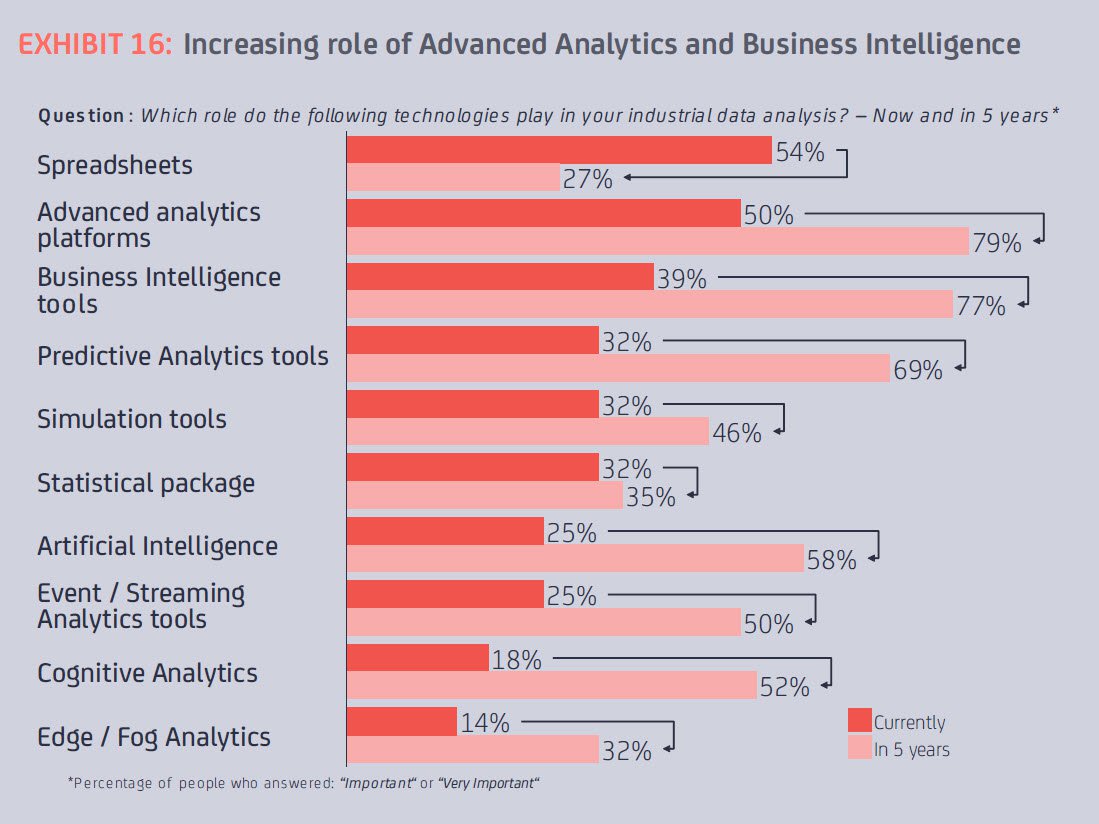

Micro Businesses are generally risk averse, making it a herculean task for an average Indian to access machine learning algorithms when they need it. It has been reported that only 2% out of the 40% of small businesses in India have been able to get an Excel-level analysis from Tally and other formal financial products.

Consequently, the average Indian Business can help distinguish itself from competitors using our Stock Analysis tool of ours. Rather than limiting promotion efforts to the products they offer, the processes that accompany the products can be viewed as an additional means of adding value for customers. For example, manufacturing firms Universal Fabricators. and Suguna Metals have produced brochures that detail how their customizable distribution capabilities benefit customers. Thus micro-entrepreneurs must look beyond cost containment and focus on customer satisfaction as a major component of the strategic direction of the company.

Embracing a customer-driven focus in the SCM process offers many tangible opportunities for micro-entrepreneurs to actively participate in business decision-making on the go. To help their firms develop customer-driven supply chains, micro-entrepreneurs should:

Appreciate the true differences between customer-driven and asset-driven Supply Chain

Identify and support initiatives that capitalize on customer value-creation opportunities in the supply chain.

Customer-Driven Versus Asset-Driven

A1 While many companies openly claim to be customer-driven, in reality, they tend to be more asset-driven. In terms of Supply Chain, customers value — and are often willing to pay a premium for — high-quality service, flexibility, reliability, customization and responsiveness. Unless firms adopt a focus broader than asset-driven cost control, the attributes critical to customer satisfaction may be overlooked.

In contrast to the internal focus of asset-driven companies, customer-driven companies maintain a more balanced focus by allocating time equally to tracking internal processes and external issues like customer needs and competitor actions. Best micro-entrepreneurs may spend as much as one day a week meeting directly with customers. Formal customer service and satisfaction data are collected and regularly evaluated. Joint problem-solving meetings are routinely held with customers.

Many customer-driven supply chain initiatives require considerable investment and may actually increase total costs. For example, an automatic replenishment program and a reverse logistics program are not only expensive to implement and time-consuming to master, but often require that firms make radical changes to existing business relationships.

“Micro entrepreneurs understand the importance of algorithms to transform the fortune of an SME. This reflects in several additional features they partnered with LendStack to design and operationalize in their quest to reach every Indian SME and individual with all the cash they need to succeed” said Krithikha Nallakumar, founder of LendStack.

Past experiences paved way for new solutions with LendStack

With over 22 years of relevant experience in the supply chain, the subject of credit and stock analysis is not a novel one to the founder, Krithikha Nallakumar. Despite extensive experience with operations at the executive level, LendStack still had to do its homework to find the best way to become a leading business app in India. The team considered various options that could support their digital lending proposition and were particularly on the lookout for a solution that would ensure a seamless and pocket-friendly execution for micro-entrepreneurs.

The team wanted to build a custom lending app and a platform that could support the supply chain operations end-to-end. With this in mind, it was easy to conclude that a Lending-as-a-Service provider was their best bet. Although the team considered embarking on their own building efforts, the cost implication of this posed an unreasonable challenge. Mayur distributors crossed paths with LendStack met with the LendStack team and came to the decision that it was a great fit. “The innovation and response pitched by LendStack pointed to their understanding of our requirements. We considered building our own platform but LendStack has grown the capacity and experience to handle what we wanted. And it came at a good price” expressed Mr Dignath Shinde CEO.

The LendStack solution

What is it about LendStack that provides micro-entrepreneurs the confidence to trust their ideas will be executed successfully?

LendStack’s cutting-edge loan management system and lending management software are designed to give micro-entrepreneurs the assurance they need. Its automated replenishment input (API) enables seamless processes where distributors handle the restocking of inventory based on real-time sales data and stock levels provided by the business. This eliminates traditional product ordering methods, allowing entrepreneurs to focus on growth rather than logistics. By using loan management workflow technology and APIs, LendStack reduces stock levels in the distribution chain, enhances efficiency, and significantly lowers the risk of stockouts.

APIs also create immense value by substituting information for inventory management. Ganesh Traders and Satish Spare Parts are two businesses that are leveraging LendStack’s API features to optimize their operations.

For example, Ganesh Traders uses APIs to streamline product shipping from their manufacturing plants to retailer distribution centers, using daily inventory data to replenish stocks. This has reduced inventory at retailer distribution centers by 50%, while improving service levels from 78.7% to 89.5%.

Similarly, Satish Spare Parts saved its retailer customers over ₹6.5 lakhs in 18 months by using APIs to maintain efficient stock levels, significantly strengthening trade relations and enhancing customer loyalty.

LendStack stands out for its comprehensive integrations with leading payment gateways and data suppliers, as well as custom credit scoring solutions. This loan lending software includes partnerships with Paytm, UPI, RuPay, GPay, and PhonePe, ensuring that businesses have access to these payment processors immediately after completing the 7-minute signup process. By providing in-depth insights and ecosystem data that improve credit decision-making, LendStack enables businesses to make smarter financial choices.

For micro-entrepreneurs looking to grow, LendStack’s loan management application offers flexibility and rapid setup. With web and mobile applications (available on Android and iOS), businesses can scale their operations without having to invest months into developing their own systems. In just a few minutes, businesses and lenders can register, access the online loan management software, and be up and running with a fully functional mobile app.

Beyond just technology, LendStack’s loan management system is designed to reduce borrowing costs and foster business growth. Its SaaS offerings, including back-office support tools like Freshworks’ chat and helpdesk solutions, help micro-entrepreneurs provide top-tier customer support, enabling them to focus on scaling their ventures.

Adding Value x LendStack experience

LendStack inventory tool adds customer value in three generic ways: effectiveness, efficiency and differentiation. It is important for micro-entrepreneurs to recognize the product differentiation opportunity.

As an increasing number of businesses use LendStack to create a competitive advantage, it is important to recognize the importance of customer-driven Stock Keeping. If micro-entrepreneurs are expected to help their firms develop customer-driven stock-keeping programs, they must first appreciate the differences between customer-driven and asset-driven perspectives. This important distinction will enhance the credibility of micro-entrepreneurs when operating in cross-functional businesses and prepare them to best identify and support initiatives that capitalize on customer value-creation opportunities.